The federal government of India has offered some updates on its cryptocurrency invoice and investigations of crypto exchanges in Lok Sabha, the decrease home of India’s parliament. “Crypto belongings are by definition borderless and require worldwide collaboration to forestall regulatory arbitrage,” stated the minister of state within the Ministry of Finance.

Indian Authorities Solutions Questions About Crypto Invoice and Regulation

The Indian authorities answered two units of questions on cryptocurrency and its regulation Monday by varied members of Lok Sabha, the decrease home of India’s parliament.

Parliament member Bhartruhari Mahtab requested the minister of finance to state “the present standing of the cryptocurrency invoice, which was due for being tabled through the winter session, 2021, of the Parliament” and “the timeframe inside which the cryptocurrency invoice could be tabled and subsequently be open for public inputs.”

Pankaj Chaudhary, minister of state within the Ministry of Finance, replied with out offering a particular timeframe:

Crypto belongings are by definition borderless and require worldwide collaboration to forestall regulatory arbitrage. Subsequently, any laws on the topic may be efficient solely with important worldwide collaboration on analysis of the dangers and advantages and evolution of widespread taxonomy and requirements.

Mahtab additional requested the finance minister to state which ministry and/or division would regulate cryptocurrencies and crypto tokens, and which might regulate different kinds of “digital digital belongings,” equivalent to non-fungible tokens (NFTs), decentralized purposes (dApps), actual property tokens, and different blockchain-based belongings.

Chaudhary merely replied:

At the moment, coverage associated to crypto belongings and associated ecosystem is with the Ministry of Finance.

Parliament Members Additionally Ask for Particulars of Crypto Exchanges Below Investigation

One other set of questions by a number of different parliament members requests “the main points of crypto exchanges that are below investigation by the federal government for cash laundering and tax evasion instances.”

Chaudhary defined that the Enforcement Directorate (ED) “is investigating a number of instances associated to crypto frauds whereby a number of crypto exchanges have additionally been discovered concerned in cash laundering.” The minister defined that as of Dec. 14:

Proceeds of crime amounting to Rs. 907.48 crores have been connected/seized, three individuals have been arrested and 4 Prosecution Complaints have been filed earlier than the Particular Courtroom, PMLA, in these instances.

Moreover, below the Overseas Alternate Administration Act 1999 (FEMA), belongings amounting to Rs. 289.68 crores ($35,046,152) have been seized. As well as, one Present Trigger Discover has additionally been issued to Zanmai Labs, which operates crypto change Wazirx, and its director below FEMA for transactions involving crypto belongings value Rs. 2,790.74 crores.

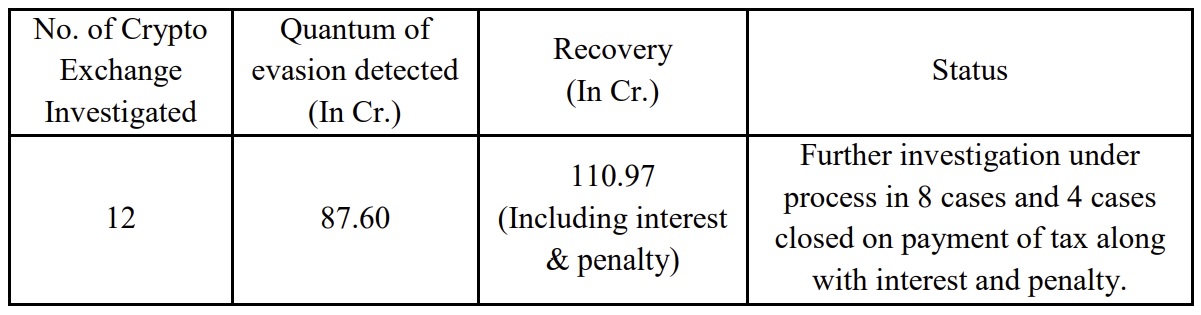

The minister added that 12 cryptocurrency exchanges have been investigated for evading Items and Providers Tax (GST). Thus far, 110.97 crore rupees, together with curiosity and penalties, have been recovered. Furthermore, eight instances are below additional investigation and 4 instances have been closed. He offered Lok Sabha with the desk under:

Chaudhary additionally clarified:

At the moment, crypto belongings are unregulated in India. The federal government doesn’t register crypto exchanges.

India’s finance minister, Nirmala Sitharaman, stated in October that the federal government plans to debate crypto regulation with the G20 nations to ascertain “a technology-driven regulatory framework” for crypto. Ajay Seth, India’s financial affairs secretary, stated final week that the G20 nations goal to construct a coverage consensus on crypto belongings for higher international regulation. Final month, U.S. Treasury Secretary Janet Yellen and Sitharaman mentioned crypto regulation through the ninth India-U.S. Financial and Monetary Partnership assembly.

What do you concentrate on the Indian authorities’s method to cryptocurrency? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.