Fast Take

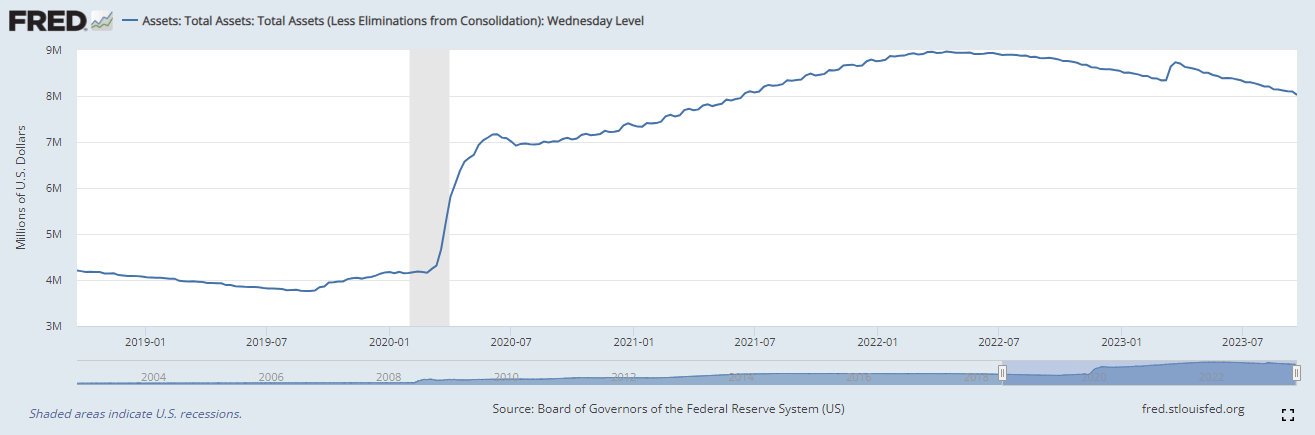

The Federal Reserve’s stability sheet of whole property has seen a discount of an extra $75 billion up to now week, with whole property now barely surpassing the 8 trillion mark. For context, previous to the COVID-19 pandemic, the Fed’s stability sheet was roughly $3.5 trillion.

Regardless of the appreciable distance but to be lined, substantial efforts have been made to scale back the stability sheet through quantitative tightening, attaining a discount of about 5.5% 12 months to this point.

It’s attention-grabbing, nonetheless, to juxtapose this with different main international central banks. The Financial institution of England (BOE) has surpassed the Fed’s discount charge with a 6.5% lower, the Folks’s Financial institution of China (PBoC) at 7.5%, and each the Financial institution of Japan (BOJ) and the European Central Financial institution (ECB) have outpaced with reductions exceeding 10%.

This continuation of quantitative tightening will put additional strain on bond yields, with the U.S. 10-year treasury yield rising to 4.5%.

This information underscores the concerted international effort by central banks to rebalance their respective monetary territories, navigating the fragile path of restoration within the post-pandemic world.

The put up Federal Reserve trails international counterparts in stability sheet reductions, information reveals appeared first on CryptoSlate.