Onchain Highlights

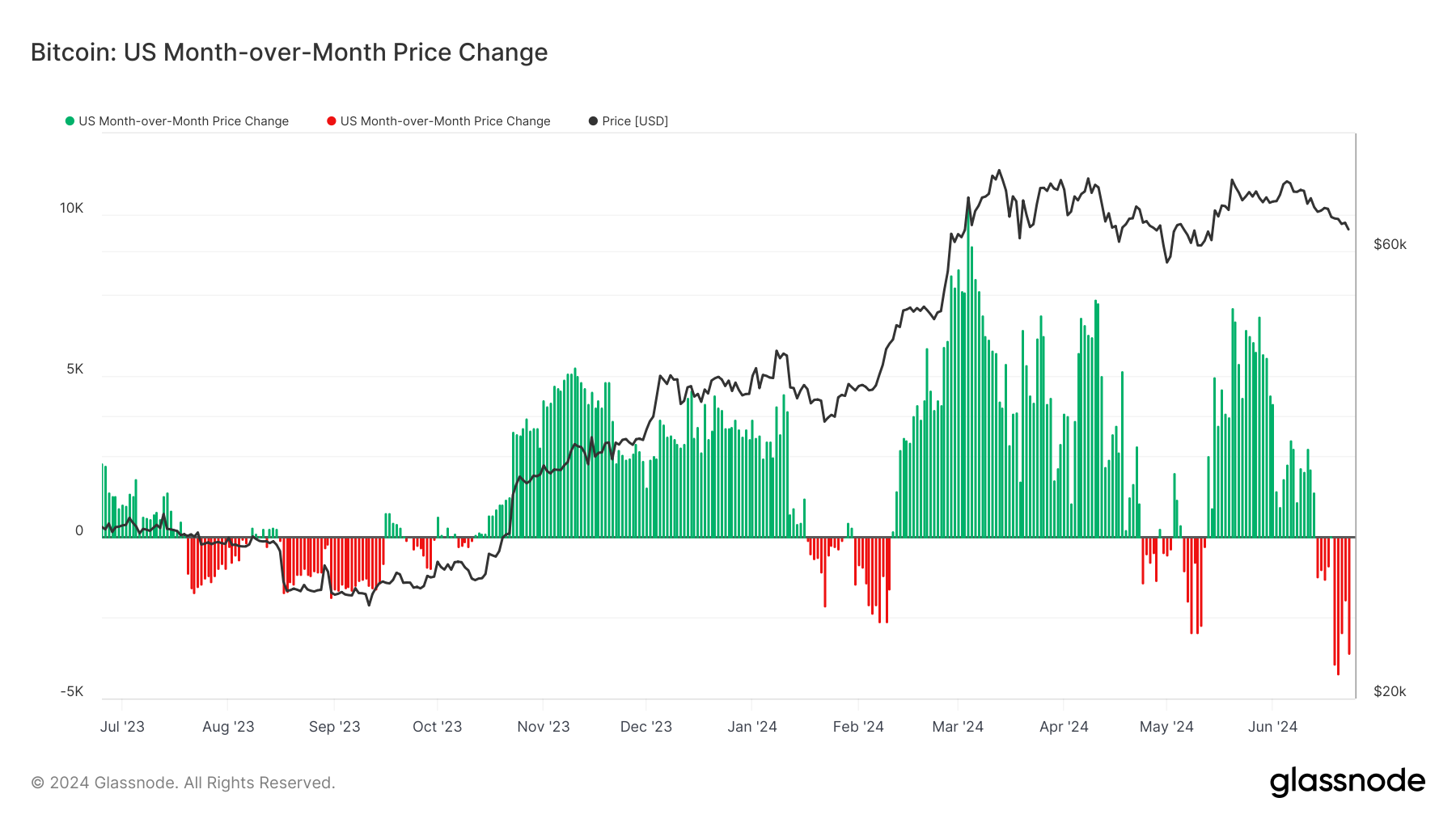

DEFINITION: This metric reveals the 30-day change within the regional worth set throughout US working hours, i.e., between 8 A.M. and eight pm Japanese Time (13:00-01:00 UTC), respectively, and Japanese Daylight Time (12:00-0:00 UTC).

Regional costs are constructed in a two-step course of: First, worth actions are assigned to areas based mostly on working hours within the US, Europe, and Asia. Then, regional costs are decided by calculating the cumulative sum of the worth modifications over time for every area.

Bitcoin’s month-over-month worth change throughout US market hours demonstrates notable fluctuations over the previous yr. From July 2023 to June 2024, Bitcoin exhibited vital volatility, with marked will increase and declines in worth. The info reveals a pattern of elevated volatility beginning in November 2023, dipping across the launch of the US ETFs after which peaking in March 2024, the place the month-to-month worth change throughout US hours approached a $10,000 enhance. Following the April 2024 halving, Bitcoin has skilled notable downward actions after a quick rally in late Might, with declines throughout US hours, reaching nearly $5,000 from mid-June 2024.

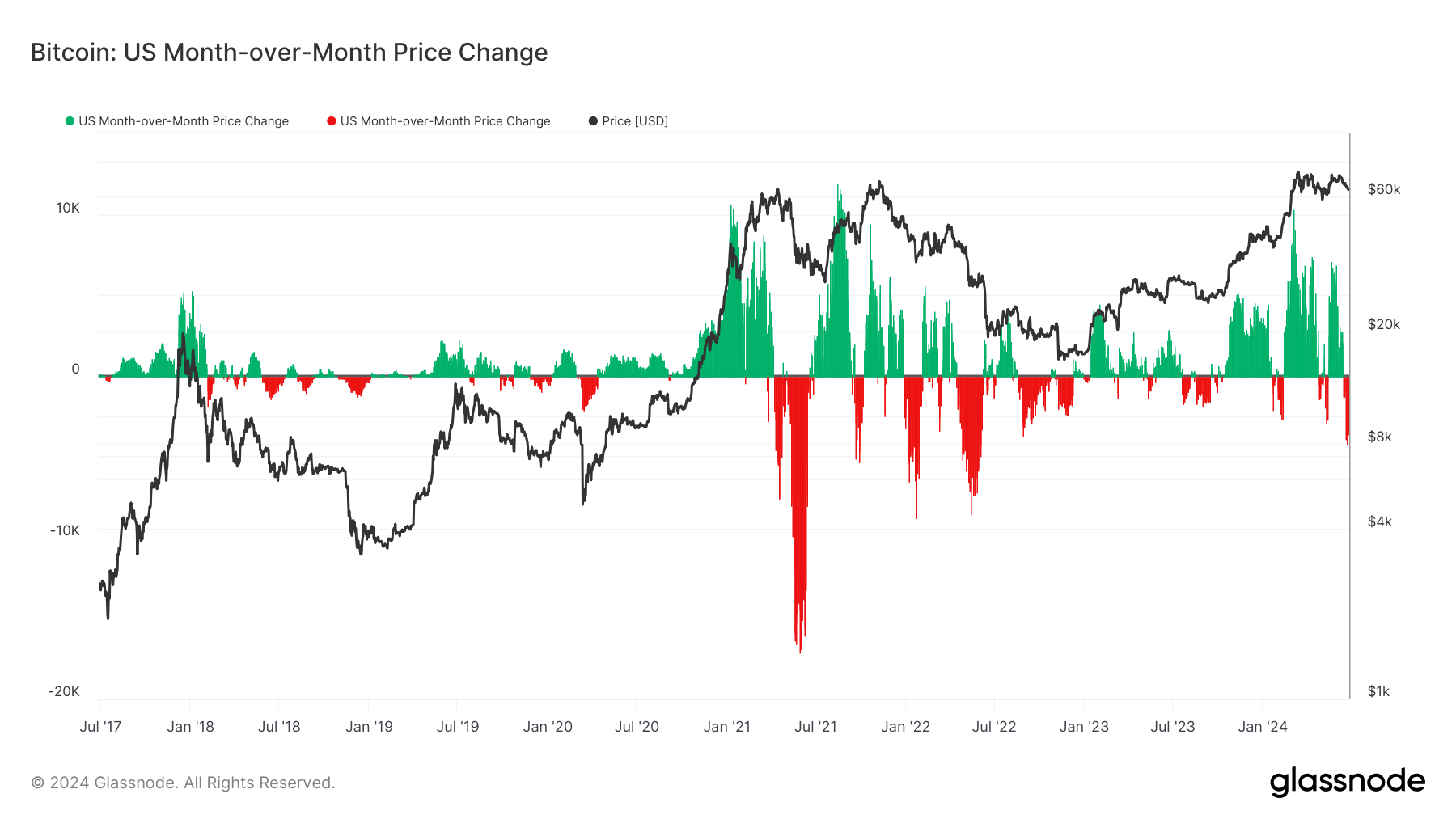

Historic evaluation reveals that such volatility isn’t unprecedented. An extended timeframe, overlaying the years 2017 to 2024, signifies comparable patterns of utmost worth actions throughout US market hours, particularly round vital occasions and main market shifts. For example, the substantial worth drops seen in mid-2021 and mid-2022 mirror the current declines post-halving.

This cyclical sample emphasizes the affect of Bitcoin’s halving occasions and broader market situations on its worth volatility throughout US buying and selling hours. Analyzing these tendencies gives vital insights into potential future actions and investor sentiment inside the digital property market.

The put up Bitcoin’s post-halving volatility throughout US hours reveals historic patterns appeared first on CryptoSlate.